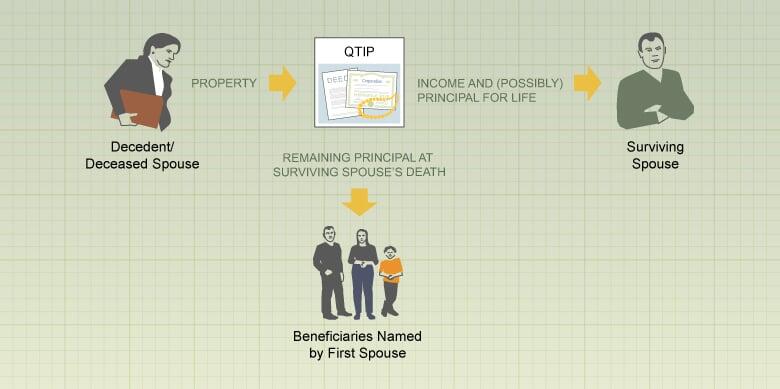

Tax attorneys and accountants love their acronyms. Some seem deliberately designed to confuse the rest of us. For example, QTIP trusts. They have nothing to do with ear cleaning or model airplane construction. QTIP stands for Qualified Terminable Interest Property and a QTIP trust is simply an instrument designed to pass on property (in a limited way) to a surviving spouse without triggering the Federal Gift Tax. The recipient spouse has an income interest in the trust and does not have a power of appointment over the principal. Upon the recipient spouse's death, the principal is included in his or her estate for estate tax purposes.

Why would someone want to set up a QTIP trust? The most common situation is when the grantor (or creator of the trust) wants to provide a home (and any income deriving from the home) for a surviving spouse during that spouse's lifetime, but wants to direct the final gift of the property upon the death of the spouse. QTIPs are often employed for second or third marriages, when the owner of the property wants to provide for the current spouse but wants the property to ultimately go to one or more of the children from the earlier marriage(s). But there are other scenarios, as well, including leaving the remaining principal in the property to a charity or somebody else altogether.

In addition, QTIP trusts give the executor of the trust more flexibility to minimize estate taxes, depending on the tax code and the financial situation of the trustee at the time of the death. In other words, your executor can choose the estate tax treatment of the QTIP trust to reflect changes in the applicable tax laws or changes in the value of your assets since you last made your will. It may also be beneficial if the surviving spouse already has significant personal assets. In that case, the executor can take advantage of the graduated tax brackets in the estate tax law for both parties, in turn reducing the overall tax paid between both spouses.

There are some nuances to QTIPs, in both how they are set up and how they are administered. For example, the QTIP trust can be written to provide the greater of $5,000 or 5% of the trust assets to the surviving spouse annually. There can be other stipulations and conditions, depending on the specific situation. In any case, the surviving beneficiaries are entitled to a full, accurate accounting of the trust assets upon final disposition so care must be taken in setting up the trust and administering it properly.