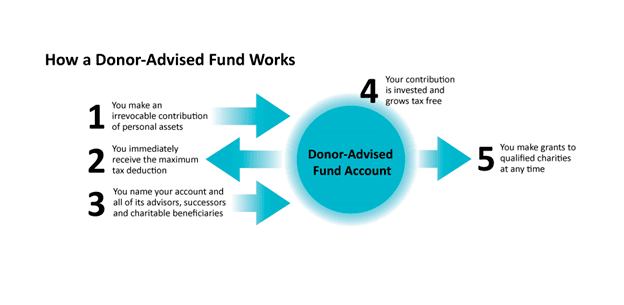

If you or your client has been lucky enough to have accumulated some wealth AND are in a situation where you are in a high-income tax bracket at the moment, you may want to investigate Donor-Advised Funds (DAFs). They offer a way to donate to the charitable causes of your choice while taking advantage of immediate tax deductions. A DAF is simply a private fund administered by a third party and created to manage charitable donations on behalf of an organization, a family, or an individual. The graphic below may help.

Benefits of Donor-Advised Funds

The most immediate benefit for donors is the ability to take advantage of a charitable tax deduction without the expense and overhead of setting up a private foundation. Unlike charitable bequests in a trust, the tax advantage is immediate and can be used to avoid capital gains taxes on highly-appreciated assets. In addition, most Donor-Advised funds can accept a wide range of non-cash assets, which can be helpful for those trying to donate highly-appreciated assets like stocks, options, interest in limited partnerships or cryptocurrency.

The funds grow tax-free and are then distributed to the charities of the donor's choice. It's fairly simple, which makes it nice for those who don't want to manage additional complexity.

Disadvantages of Donor-Advised Funds

There are a couple of clear disadvantages of these funds. Because of the tax advantages, the initial contribution is irrevocable. That means that, although you can change the recipient(s) of the funds, you cannot get your money back if it is needed. Also, while the donor can earmark where the donations should go, the managing institution ultimately controls the gift (hence, the term Donor-Advised).

Also keep in mind that DAFs generate money for financial institutions, just like other investment vehicles. And some financial institutions are less than forthcoming about all their fees, which can add up quickly. There is a reason why all the major investment houses (Fidelity, Schwab, etc.) push DAFs hard. It may be good for their clients in some situations, but they are also very lucrative.

There have also been a number of criticisms about DAFs in terms of financial institutions simply holding onto the money and racking up fees. While private foundations are required to pay out 5% of their assets annually, DAFs have no restrictions and can hold onto the funds as long as the deem fit. This skirts the original intent of streamlining charitable donations to worthy causes and makes these funds more of a tax play for donors and a source of recurring fee income for the financial services industry. It is worth asking the DAF about the percentage of funds donated annually and to whom.

Who Should Consider Donor-Advised Funds

If you are sitting on highly-appreciated non-cash assets such as stocks or other investments AND have sufficient current income to take advantage of a large write-off, DAFs may make sense for you. That last part is important - you can deduct up to 60% of Adjusted Gross Income (AGI) on your federal returns for cash contributions and up to 30% of AGI for stock contributions. Depending on the state, you might get additional tax breaks on your state returns. But if you don't have sufficient current income, some of these advantages may disappear.