Most of us over a certain age have a will or a trust set up to pass on our assets to specific people or organizations. Some wills and trusts even have complex rules for how the assets are to be divided and disbursed (not until the beneficiary is a certain age, with some conditions, etc.). But a surprising number of us pass on without a formal document specifying our wishes. This can lead to serious problems.

In most cases, estates are divided and passed on in a fairly simple way, with the main drawback of dying intestate (without a will) being that the beneficiaries have to go through the probate process. The probate process involves the Court and can take considerable time and expense. However, family structures and dynamics are complicated. Many people do not have clear familial relationships that make dividing their estates simple. In those cases, determining who gets what becomes complicated.

Each state has its own rules for distributing assets in the absence of a will or trust. California's rules are outlined in the California Probate Code 6400-6455 and are summarized below. *

- If the decedent created no will or trust and was married with no children: All assets are distributed to their surviving spouse.

- If the decedent created no will or trust and was not married but has children: All assets are distributed to the decedent’s children.

- If there is more than one child, then assets are shared equally amongst the living children. If a child predeceased the decedent, that child’s children will take that child’s share.

- If the decedent created no will or trust and was married with children: Decedent’s community property assets are distributed to the surviving spouse. Decedent’s separate property is distributed to the surviving spouse and the children, one-half to each if only child and one-third to the surviving spouse and two-thirds to the children if more than one child.

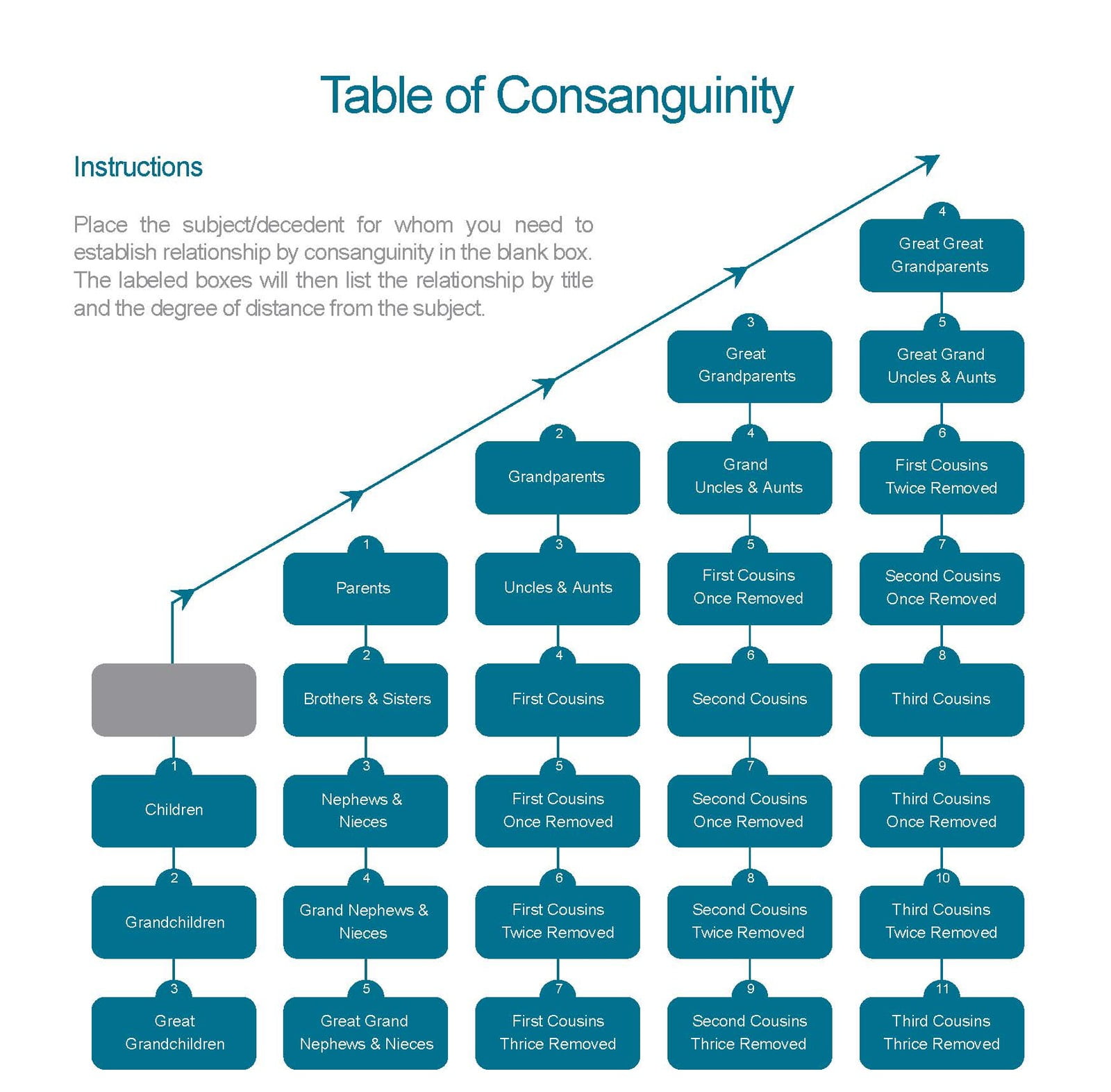

- If the decedent created no will or trust and has no spouse or children: All assets go to the decedent’s kin or heirs based the closest relationship, e.g. first parents, then siblings, then cousins, etc..

- If the decedent created no will or trust and has no heirs or kin: All assets escheat to the state.

* The California Probate Code is the source of truth in these matters. It is updated periodically. You should refer to the current version of the California Probate Code and a qualified attorney rather than rely solely on summary above, which may become out of date and is deliberately simplified for the purposes of this blog.