The term "Dynasty Trust" conjures up visions of landed estates being passed down through the generations, with perhaps a staff of groundskeepers and butlers staying on to teach life lessons to the little rich kids. Real Downton Abbey stuff. Or perhaps it reminds you of the early 80's TV series (it truly was not the Golden Age of television).

But, in reality, Dynasty Trusts can be used to pass down and protect assets in a variety of situations. Fundamentally, they are just trusts that name someone in the family other than the grantor's children as the beneficiary. The most common scenario is to name the grandchildren. They were originally created for very wealthy families, to avoid the Generation Skipping Transfer Tax (GSST), which Congress enacted back in 1976 to close a loophole that allowed families to avoid estate taxes. The GSST is pretty steep, at a flat 40%, so there is a strong incentive to avoid it. However, the GSST estate tax exemption is $12.06M (in 2022) so most of us don't have to worry about it. For those who do, though, a Dynasty Trust can be helpful.

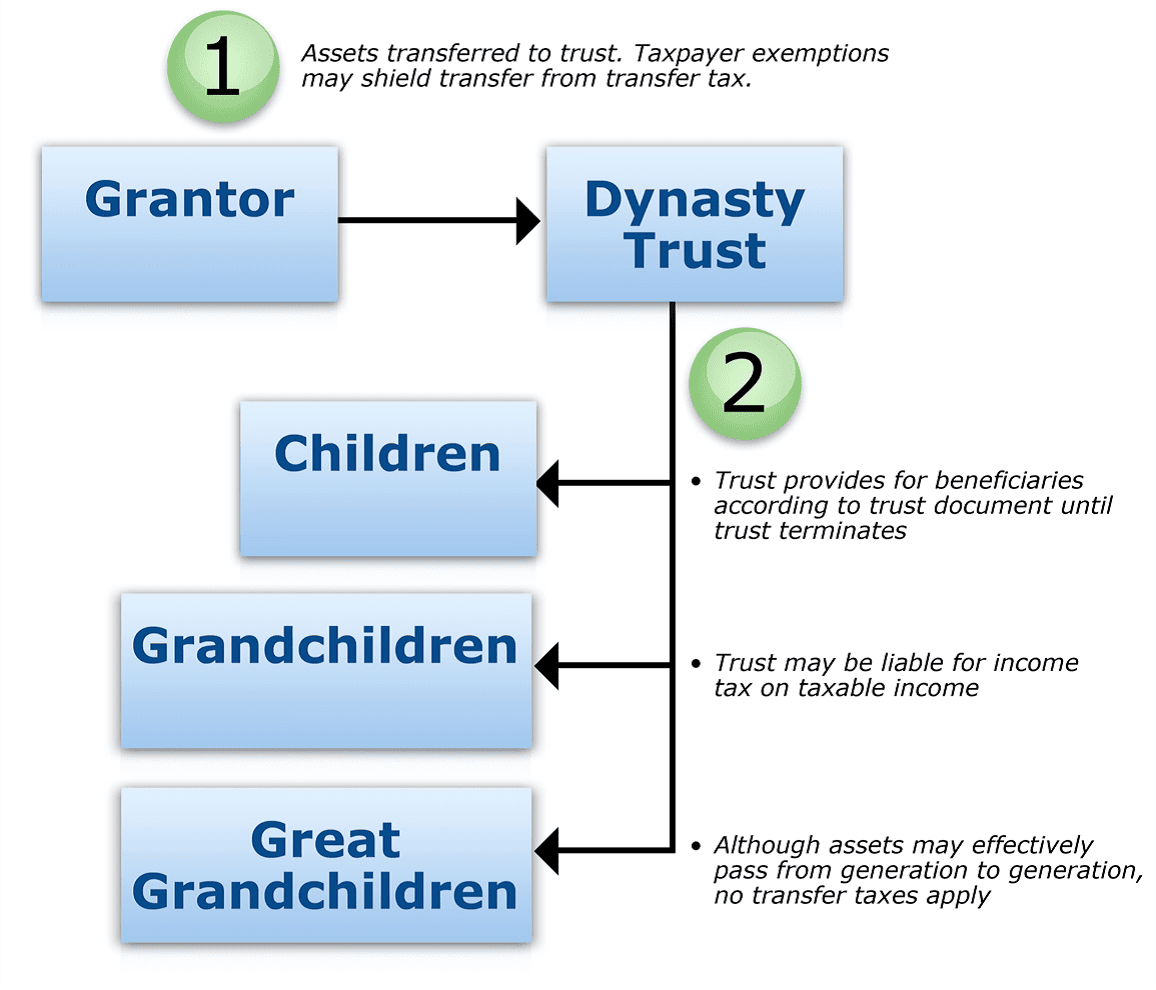

What does a Dynasty Trust look like? The graphic below may help. Throughout the life of the trust, the trust provisions control who can benefit from the trust and to what extent. That is, there can be limitations on the ability to draw income, access principle, what the money can be spent on, etc. This can be a useful tool if the grantor suspects that one or more of the beneficiaries may be a spendthrift or otherwise use the assets in some way contrary to the wishes of the grantor.

There are two other scenarios in which a Dynasty Trust may make sense. The first is to shield wealth from a beneficiary's spouse in case of a divorce. The second is to also shield wealth from creditors in the case of a beneficiary's bankruptcy. In both cases, the assets of the trust are shielded because they are not technically part of the beneficiary's assets. This is a bit of a workaround, since it is difficult for a person to set up this sort of protection for themselves but a grantor can set it up for a descendant.

There are some limitations and requirements for Dynasty Trusts that you need to take into account. The trust must be upheld, which means annual tax returns must be filed on behalf of the trust. There may be requirements to report to beneficiaries. And there is a limit on how long Dynasty Trusts can last. In California, the rule is that the trust can only last as the following formula:

[Birth of the youngest beneficiary]

+

[Youngest beneficiary's lifetime]

+

21 years

Practically speaking, this means that these trusts expire about 90-100 years after they are established. That may seem like a long time, but it's something to keep in mind when dealing with large trusts which may still have assets at expiration. It also means that Dynasty Trusts are good candidates for naming a professional trustee (a bank, a trust company, or a professional fiduciary), since they are a long-term instrument, often with complex rules.

For those of you who learn better through video, there is a very good explainer video from Ellen Cookman on her YouTube channel, which I highly recommend.