There are any number of areas where human ingenuity runs wild. Art, warfare, sex, the Marvel Universe, sports statistics - all these subjects compel crazy creativity and obsession. Based on my experience as a fiduciary, I think we can add tax avoidance to the list. Literally millions of hours are spent annually on complex schemes designed to keep as much money as possible out of the hands of tax authorities. People will go to great lengths to shave even a tiny fraction off their tax bill. For some it's a principle ("It's my money and the government shouldn't get any of it"), while for others it seems to be more of a game, where it's fun to manipulate the rules and find loopholes. I've been at conferences where financial professionals trade schemes on tax avoidance that, when you pencil it all out, may or may not save 1% in taxes on an estate, while exposing the client to potential audits and liability. It's clever, but a little pointless.

There are, however, a number of situations where a smart tax strategy can legitimately help people extend their retirement savings, live a better quality of life, leave more to their beneficiaries and help out a worthy charity. The most common scenario where I live (in the Bay Area) is dealing with highly appreciated assets (typically property or tech stocks that have been held a long time). Some of my clients are facing potential tax liabilities on $2-5M of appreciation, while having relatively little in income and liquid assets. They are counting on that appreciation to fund them through the end of their lives and to leave something to their heirs. In these cases, a Charitable Remainder Trust may make sense.

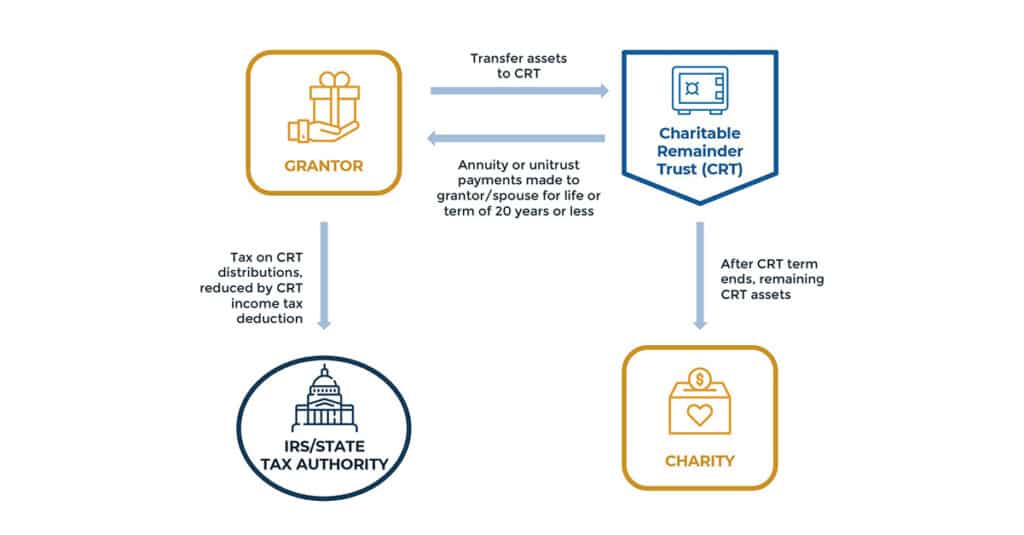

I recently attended a great seminar presented by Anita Gat, Sean Buxton and and Dan Berris on Charitable Remainder Trusts. That prompted some more deep diving on my part. The simple summary is that a trustor can place a highly-appreciated asset into a charitable remainder trust with a designated charity as the remainder beneficiary. Upon the sale of that asset within the Trust, the trustor avoids any capital gains tax. Interest on the proceeds of the sale accumulate tax-free. The beneficiaries are entitled to the income from the trust at their normal tax rate. At the end of the Trust (typically upon the death of the trustor/primary beneficiary) the charity is entitled to the remaining assets of the Trust.

There are a number of conditions and nuances to Charitable Remainder Trusts. For example, at least 10% of of the original Trust assets must be transferred to the charity. Real estate must be owned free and clear, with no outstanding mortgage debt. You don't have to put 100% of the value of your property or portfolio into the trust, so you can balance your need for income and tax savings with the desire to leave more to your heirs. Since this is a somewhat complex trust instrument, it's best to work with an estate attorney and financial planner with experience in this area. They can run the financial models to make sure that it makes sense to do this in your particular situation and to steer you away from common mistakes in the administration of the trust.