One of the pleasures of working as a fiduciary is adapting to the needs of my clients. Each client is different and requires different services. And those services can change over time as clients' situations change. Some of my earlier posts have been about relatively sophisticated financial planning instruments (Special Needs Trusts, ABLE accounts, passing real estate between generations, etc.). These are interesting and can create a lot of value.

But many clients have a need for straightforward financial management in the form of daily money management.

What is daily money management? To simplify, it is just about managing day-to-day financial tasks. A sample list of activities might be:

- Collecting bills in one place

- Reviewing bills for accuracy

- Communicating with creditors

- Questioning or challenging inaccurate or fraudulent charges

- Stopping unneeded recurring charges (forgotten subscriptions and automatic payments)

- Paying bills

- Keeping records of paid bills

- Making bank deposits

- Organizing tax information

- Clear summaries and communication with the client and other appropriate parties (if any)

- Budgeting and tracking (if asked to do so)

There are a number of reasons for outsourcing daily money management. Clients may find the tasks difficult or impossible, they may have too much going on in their life (career, family, health) or simply don't like doing them.

Not all clients need all of the tasks above. In fact, most do not. Some clients simply want their bills collected and organized. I review the bills, create a summary, fill out the checks and go over each one with the client. The client signs the checks and I post them. It is a very light process completely under the watchful eye of the client. Some clients want me to manage the whole thing. Most want something in the middle. In each case, the key is to talk with the client, propose a solution and then communicate and adapt as we go through the process.

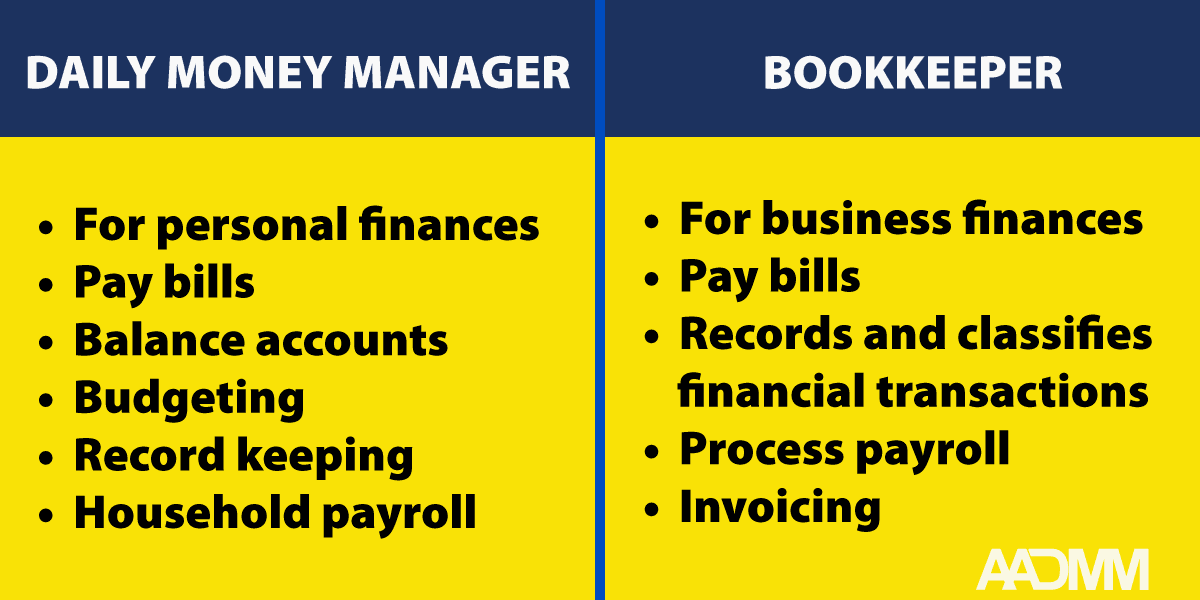

Some of my clients have asked me the difference between a daily money manager and a bookkeeper. While some of the tasks are the same, the general rule of thumb is that a bookkeeper works for a business while a daily money manager works for an individual. The graphic below may help.

In nearly all cases, the cost of a daily money manager is more than compensated by discovering unnecessary or fraudulent charges, stopping old subscriptions or automatic payments and eliminating late fees and interest charges. Clients and family members also appreciate the peace of mind that comes from clear expense summaries and communication.