Special Needs Trusts (SNTs) are more or less what they sound like. They are trusts designed for individuals who are unable to be gainfully employed in a full-time capacity (see definition below) and who don't want to forego the government aid to which they are legally entitled. Pretty straightforward. But just about every government agency with an acronym has jumped into the fray with their own set of rules and regulations: the Social Security Administration, the IRS, MediCal, MediCaid, the California Probate Code, SSI, Congress, etc. Because of the resulting thicket of regulations, rules and exceptions, setting up and administering an SNT is a task best left to the professionals.

First, some definitions:

- “Disability” is the inability to engage in any “substantial gainful activity” (SGA) due to any medically determinable physical or mental impairment, or combination of impairments, that has lasted or can be expected to last for a continuous period of at least 12 months or result in death. 20 CFR §416.905

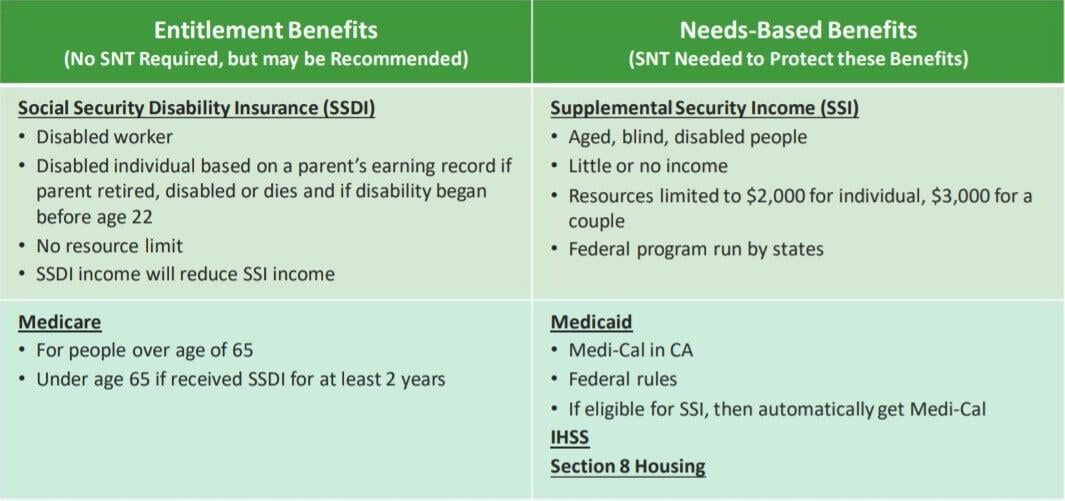

- There are income and resource limits for qualifying for public benefits and they can be fairly complex and restrictive. In 2021, the SGA income limit is $1,310 per month, i.e., income below $1,310 is not considered SGA for purposes of determining whether an individual is disabled. For Supplemental Security Income (SSI), the resource limits (money in the bank, other non-house assets) are $2,000/person or $3,000/couple. For California, the structure below is a very simplified overview.

- Funds disbursed from a Special Needs Trust cannot be spent in certain categories (food, cash, housing, etc.) without a resulting reduction in public benefits. That reduction in public benefits can be substantial and can wipe out the benefit of an SNT without careful oversight.

There are different types of Special Needs Trusts. The most common are First Party (where the beneficiary funds the trust themselves) or Third Party (where someone else funds the trust for the benefit of the beneficiary). Each of these types of trusts comes with its own set of rules, limits and reporting requirements.

There are a number of best practices for how to administer Special Needs Trusts that ensure the best outcome for the beneficiary while staying within the Federal and State rules. A Special Needs Trust can also be paired with an ABLE (Achieving a Better Life Experience) account in some cases to allow trustees and beneficiaries more flexibility and autonomy (if desired), along with some tax benefits.

If you have a family member who could benefit from a Special Needs Trust, work with an estate attorney and fiduciary who understand the tradeoffs involved and who can set up and administer the trust efficiently and legally for your loved one.